Efficient Accounts Receivable Management Services

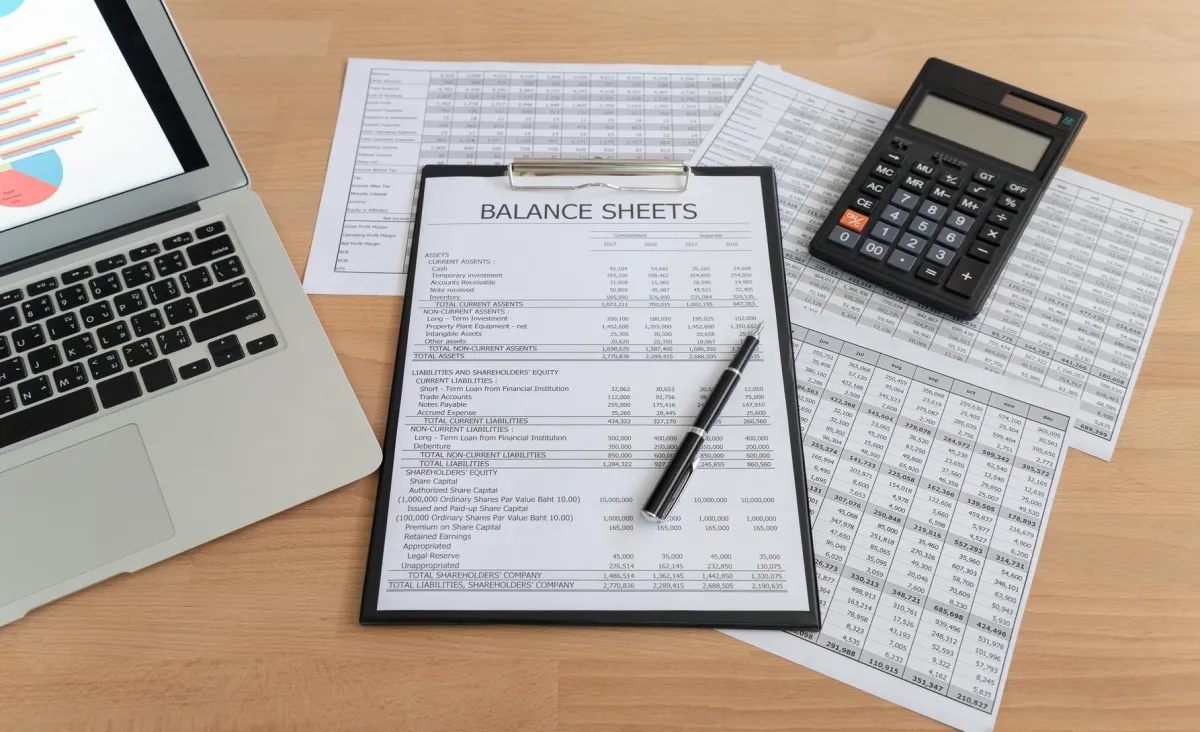

Managing accounts receivable efficiently is crucial for maintaining a healthy cash flow and ensuring the financial stability of your business. Our professional

accounts receivable management services are designed to optimize your AR processes, reduce outstanding receivables, and improve your overall financial health.

Streamlining Your AR Process

Efficient accounts receivable management begins with a streamlined AR process. The goal is to ensure that invoices are processed quickly, payments are collected promptly, and any issues are resolved without delay. Here are some key steps to streamline your AR process:

Automate Invoice Processing: Utilizing software solutions to automate invoice processing can significantly reduce errors and speed up the invoicing cycle. Automation ensures that invoices are sent out promptly and accurately.

Implement Clear Payment Terms: Clearly stated payment terms help set the expectation for when payments are due. This minimizes confusion and encourages timely payments.

Regular Follow-Ups: Establish a routine for following up on outstanding invoices. Regular communication with clients can help identify and resolve any issues that may delay payment.

Monitor AR Aging Reports: Regularly reviewing AR aging reports helps you identify overdue accounts and take proactive measures to collect outstanding receivables.

Best Practices for Accounts Receivable

Adopting best practices for accounts receivable management can help you maintain control over your receivables and improve your cash flow. Here are some effective strategies:

Credit Checks for New Clients: Conducting credit checks on new clients can help you assess their creditworthiness and set appropriate credit limits.

Offer Multiple Payment Options: Providing clients with multiple payment options, such as credit card, ACH, and online payments, can make it easier for them to pay on time.

Early Payment Incentives: Offering discounts for early payments can incentivize clients to pay before the due date, improving your cash flow.

Consistent Collection Procedures: Establishing consistent and fair collection procedures ensures that all clients are treated equally and that overdue accounts are handled systematically.

Benefits of Professional AR Management

Outsourcing your accounts receivable management to a professional service provider offers numerous benefits:

Expertise and Experience: Professional AR service providers have the expertise and experience to manage your receivables efficiently. They stay updated with the latest industry trends and best practices.

Time Savings: By outsourcing AR management, you can free up valuable time and resources to focus on core business activities.

Improved Cash Flow: Professional AR services can help reduce the time it takes to collect payments, improving your cash flow and reducing the risk of bad debt.

Enhanced Customer Relationships: AR service providers can handle collections diplomatically, maintaining positive relationships with your clients while ensuring timely payment.

How We Improve Cash Flow

Our accounts receivable management services are designed to optimize your cash flow and ensure that you have the funds necessary to run your business smoothly. Here’s how we do it:

Efficient Invoice Processing: We use advanced software to automate and streamline theinvoice processingcycle, ensuring that invoices are sent out promptly and accurately.

Proactive Follow-Ups: Our team conducts regular follow-ups on outstanding invoices, addressing any issues that may delay payment and encouraging timely payment from clients.

Customized Payment Plans: We work with your clients to create payment plans that suit their financial situation, ensuring that you receive payments without straining your client relationships.

Regular Reporting and Analysis: We provide regular reports and analysis on your AR performance, helping you make informed decisions to further improve your cash flow.

Frequently Asked Questions About AR Management

Q1: What is accounts receivable management?

A1: Accounts receivable management involves tracking and managing the money owed to your business by clients. It includes sending invoices, collecting payments, and handling any issues related to outstanding receivables.

Q2: Why is efficient AR management important?

A2: Efficient AR management is crucial for maintaining a healthy cash flow, reducing bad debt, and ensuring that your business has the funds necessary to operate smoothly.

Q3: How can professional AR services benefit my business?

A3: Professional AR services can improve your cash flow, save you time, enhance customer relationships, and provide you with expert insights and strategies for managing your receivables.

Q4: What are some best practices for managing accounts receivable?

A4: Best practices include automating invoice processing, implementing clear payment terms, conducting credit checks for new clients, offering multiple payment options, and maintaining consistent collection procedures.

Q5: How do AR services help improve cash flow?

A5:AR services improve cash flow by ensuring that invoices are processed efficiently, payments are collected promptly, and any issues delaying payments are addressed quickly.

Contact Us For Professional Bookkeeping Services

Take the guesswork out of managing your finances with Pro Bookkeeping Solutions. Reach out to us today to discover how our expert team can provide you with tailored reports and insights that no other bookkeeping service offers, ensuring your business stays ahead of the competition.

Thank you for taking your valuable time to review our website, if you have any questions feel free to let us know

Danny & Kimberly Garcia

Contact Us Today

Pro Bookkeeping Solutions

Navigation

Contact Us

Professional Bookkeeping Solutions

1012 S Fulton Street

Salisbury, NC 28144

813-345-4097

© 2024 Professional Bookkeeping Solutions. All Rights Reserved